SESLOC Mobile App app for iPhone and iPad

Developer: SESLOC Credit Union

First release : 03 Dec 2012

App size: 32.4 Mb

Manage your SESLOC accounts securely and conveniently from anywhere, using the SESLOC Mobile App. Whether you want to check your account balance, view your account info, or deposit a check, you can do it all from your mobile device. Features include:

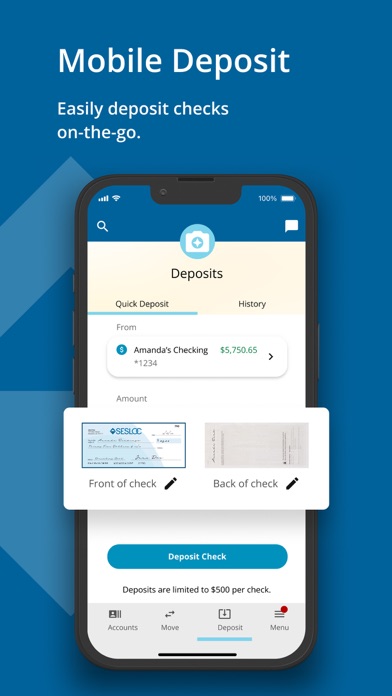

MOBILE DEPOSIT

It’s a snap. Skip a branch visit and deposit checks anywhere, anytime.

APPLE WATCH

Sync the SESLOC Mobile App to your Apple Watch to view the latest transactions and get account balances.

ALERTS

Receive text, email or push notifications of activity to help protect yourself from fraud.

BILL PAY

Pay bills directly from your SESLOC account. Schedule payments and save on postage.

TRANSFERS

Transfer funds between your SESLOC accounts, or transfer to another financial institution.

eSTATEMENTS

Go paperless to reduce clutter and be more sustainable. These digital (pdf or html) files are securely stored for up to 24 months.

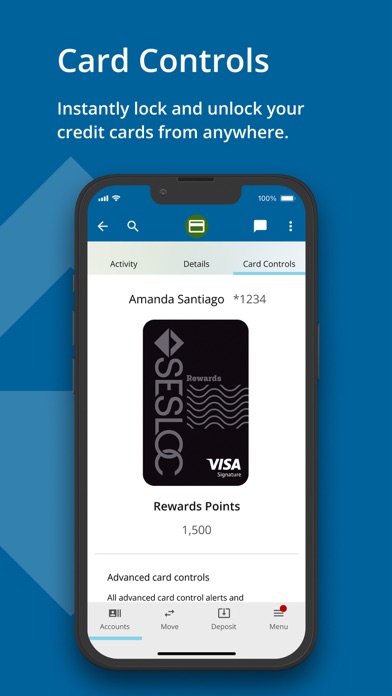

REWARD POINTS

Eligible cardholders can view points earned and access the rewards redemption website.

FINANCIAL TOOLS

Set budgets, track spending and see your net worth, even across accounts at other financial institutions.

CARDSWAP

Update all of your payment information for online or subscription services in one place.

OPEN ANOTHER ACCOUNT

Including secondary savings accounts and select share certificates.

SECURE LIVE CHAT

Chat online during regular business hours or send a secure message.

*******

It’s people that make the place. The go-getters, the do-gooders, the kick-backers. And that’s exactly who we’re here for. Were SESLOC. And we give you the financial tools to find your success. So whether you need to deposit a check, open a new account or apply for a loan, the SESLOC Mobile App, branches or our Contact Center are here for you. After all, this is our community. So we look out for each other. Because when one of us succeeds, we all succeed. It’s not just the neighborly thing to do - it’s the right thing to do.

*******

SESLOC is a not-for-profit credit union serving the San Luis Obispo and Northern Santa Barbara County community. Savings are insured to at least $250,000 and backed by the full faith and credit of the U.S. Government. National Credit Union Administration (NCUA), a U.S. government agency.

Membership in good standing is required for all credit union benefits.

Equal Housing Lender.